The Two Basic Types of Cost Accounting Systems Are

Breadwonders7785 is waiting for your help. Job order and process cost systems.

What Is Cost Classification Definition Basis Of Classification The Investors Book

Job order and job accumulation systems.

. Job order and batch systems. The primary costing systems are noted below. Job order costing and customized product costing.

The two basic types of cost accounting systems are a. Job order and job accumulation systems D. Terms in this set 29 Cost accounting.

1 a job order cost system and 2 a. The two basic types of cost accounting systems are process cost and activity based cost systems. There are two main cost accounting systems.

The job order costing and the process costing. Assigned to multiple WIP accounts How would we handle MOH in order to get the most timely job cost information. Multiple Choice Job order costing and periodic costing.

There are two basic types of cost accounting systems. Job order and batch systems C. C job order and process cost systems.

The Two Basic Types of Cost Accounting Systems Are Get link. Job order and process cost systems B. The following points highlight the top six types of costing systems.

Job order and job accumulation systems. Process cost and batch systems. Job order and batch systems.

Job order and process cost systems. Job order and process cost systems. The two basic types of cost accounting systems are.

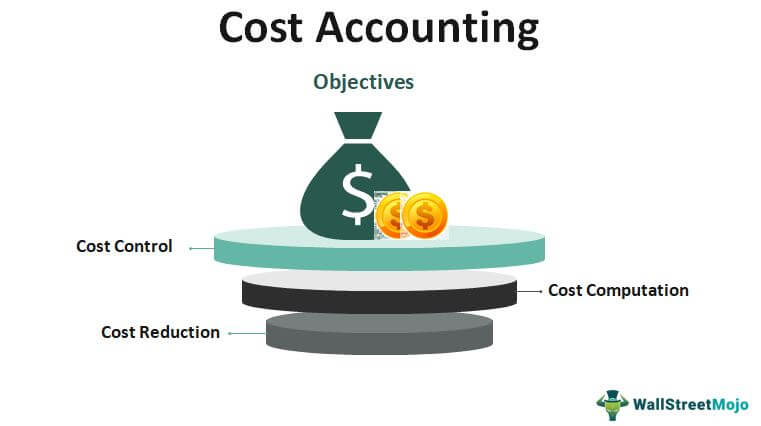

A pool of activity costs associated with particular processes and used in activity-based costing ABC systems. A cost accounting system has five parts. Despite all the complexities cost accounting can largely be broken into fixed and variable costs.

The other costs can be fit into either the fixed or variable categories. Input Measurement Basis The cost accounting system starts with determining the type of costs that flow into the inventory accounts. Job order costing and periodic costing.

Job order costing is a cost accounting system that accumulates manufacturing costs separately for each job. There are two basic types of cost accounting systems. Required fields are marked.

There are three types of Input Measurement Basis Historical Normal Historical and Standard Historical. Job order process cost When costs are assigned in the process cost system. The two basic types of cost accounting systems are _____.

Leave a Reply Cancel reply. D job order and job accumulation systems. There are two main types of costing systems.

The two basic types of cost accounting systems are A process cost and batch systems B job order and batch systems. Job order and process cost systems. The job order costing and the process costing.

Job order and batch systems. Job order cost system. Process cost and batch systems.

Raw materials are easily traceable to a finished product. Edmiston Company reported the following year-end information. The company assigns costs to each job or to each batch of goods.

Process cost and batch systems. Your email address will not be published. Consists of accounts for the various manufacturing costs.

The two basic types of cost accounting systems are. Job order and job accumulation systems. Job order costing and process costing.

It involves measuring product costs. Company will apply overhead using the estimated rate Calculate contribution marginCM. A business can accumulate information based on either one or adopt a hybrid approach that mixes and matches systems to best meet its needs.

Direct indirect fixed and variable are the 4 main kinds of cost. 71 Which of the following represents the two basic types of cost accounting systems. Job costing is used most often when one-of-a-kind or distinct batches of product are produced.

Acc 561 Week 3 Quiz Cost Accounting Wellness Design Accounting 5 Types Of Financial Statements Balance Sheet Income Cash Flow 2 Financial Statement Accounting And Finance Financial. Job order and batch systems. Cost of goods manufactured 750000.

Job order and process cost systems. There are two main cost accounting systems. Process cost and batch systems.

Two basic types of cost accounting systems. View Notes - There are two basic types of cost accounting systems from ACCT ac 202 at Montgomery College. In this type of costing system the costs are ascertained only after they have been incurred.

Beginning work in process inventory 80000. Job Costing In job costing actual costs are tracked and allocated to a specific product or batch. Inventory Valuation Method This involves valuing the cost of inventory.

Job Costing System Materials labor and overhead costs are compiled for an individual unit or job. Job order costing and perpetual costing. For costs the primary two cost accounting methodologies are job costing and process costing.

It is appropriate for firms that are engaged in production of unique products and special orders. Job order and job accumulation systems. Involves the measuring recording and reporting of product costs.

Job order costing and customized service costing. Job order costing is a cost accounting system that accumulates manufacturing costs separately for each job whereas Process costing is a cost accounting system that accumulates manufacturing costs separately for each process. In addition to this you might also want to look into operating costs opportunity costs sunk costs and.

Cost Accounting Objectives Importance Zoho Books

Types Of Costs And Their Basis Of Classification Accounting Education Cost Accounting Bookkeeping Business

Comments

Post a Comment